Way back in January, I bit the bullet and signed up for an account at Mint.com, a free, web-based personal finance tool. Moving into a new house had brought with it a substantial amount of financial responsibility, and I wanted an easy way to track where my money was going. Now that I've been using it for 7 months or so, I thought I'd post a few thoughts on the service.

Security

Before I get too far into my description of the service, let me talk about security (which was my number one concern when I joined). When you sign up for an account at Mint.com, you give them your personal login credentials for things like your bank account, credit card, mortgage, etc. I'll give you a moment to recover from your heart attack. Now that you're back, let's go over how Mint keeps that information safe. First of all, Mint collects no personally identifying information. When you sign up, all they ask for is:

- An email address (your user ID)

- A password

- A zip code

That's it. No name, no social security number, no address; none of that. Second, and most importantly in my opinion, is the fact that Mint is a read-only service. You cannot pay bills via Mint, you cannot transfer money via Mint, and you cannot withdraw money via Mint. The service is intended to be used as an organization and analyzing tool.

Third, Mint stores your usernames and passwords separately from your financial data. In other words, your credentials are stored on separate physical servers. All of this is handled with the same security used by banks for electronic transactions (in fact, the software being used behind the scenes is, in many cases, the exact same software being used by banks on a daily basis). Even though you're providing login information, I like the fact that, at any time, I can change my login info to essentially lock out the Mint service. If Mint ever gets hacked, it's just a matter of changing my passwords at my various financial institutions to keep any "bad guys" out.

The security page at Mint.com has lots more information, along with a video from the CEO describing how their security works in more detail. I recommend checking it out.

Budgeting and Cash Flow

For most folks, the meat and potatoes of Mint.com comes in its budgeting and cash flow tools. Mint allows you to set a budget for various categories each month, and it will even modify your budget over time as it analyzes your spending habits (which I think is a great feature). I only casually use budgets, so I'm going to gloss over that part of the site for now.

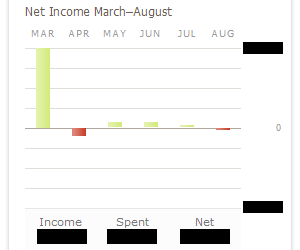

One of my favorite parts of Mint is the cash flow analysis graph. Unfortunately, this graph is limited to six months at a time (I wish I could specify a larger duration, such as a year). I'm hoping that Mint will improve this functionality, but for now I can live with it. Here's a snapshot of my cash flow graph as of last night (the values have been censored to protect the innocent):

With this handy graph, I can see whether or not I'm making money each month. As you can see, March was a great month for me income-wise, thanks to a first-time home buyer's loan, and a sizable return on my taxes. The following month was a net loss since I made an extra mortgage payment (again, thanks to that sizable income in March). And each month since that time, I've been saving more than I spend (August is in the red, but I haven't been paid yet). When I log into my Mint account, this is the first graph I look at and the one I find most interesting.

Transactions

The other most useful view to me is the Transactions view. It lists all of the transactions in all of your accounts: withdrawals from ATMs, purchases you've made on your credit cards, interest earned in your bank accounts, etc. In this view you can categorize various purchases and filter the data a number of ways. Rules can be created to automatically rename and categorize recurring transactions. Think of it as a ledger specifying each and every transaction that happens. I personally use this view to keep track of whether or not I've made certain payments, and to keep track of how much interest I'm earning each month in my bank accounts.

Alerts

Mint makes it easy to set up alerts for various things. I have several alerts set up to watch for unusual spending. For example, whenever a very large transaction comes through (> $1000, for example), I can get an email or text message. This capability is very useful for keeping an eye on your accounts, allowing you to quickly respond to transactions that you may not have made. I consider this an extra safety net in watching for stolen credit card information, a hacked bank account, etc. You can also elect to get weekly summary emails, making it easy to keep tabs on your funds without even having to log in.

Spending Trends

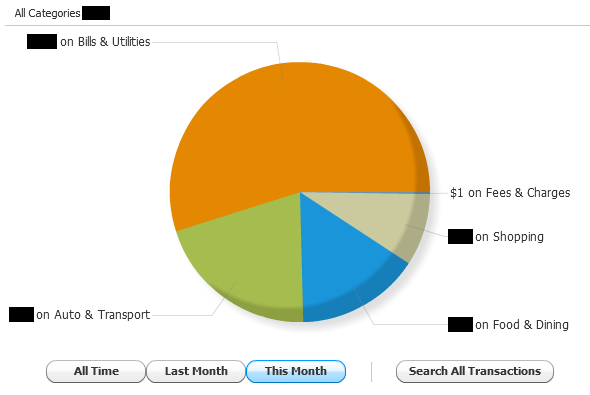

Spending trends is a great way to see how your money is divided up each month. Here's a snapshot of my spending trends for this month (it's admittedly not as exciting as a full month's worth of data would be):

I pay the vast majority of my bills at the beginning of the month, which accounts for the large chunk of money being sent to that category so far. Usually, my mortgage payment (filed under the 'Home' category) is the largest chunk, but I have yet to make that payment this month. As I said, the more data you have for a month, and the more categories are represented, the more interesting this pie chart becomes. It's cool to see where the bulk of your expenses goes each month.

It's also worth pointing out that the graph is interactive. Click a slice of the pie, and the chart will zoom into that slice, and break down how that slice is, itself, broken up. Very slick.

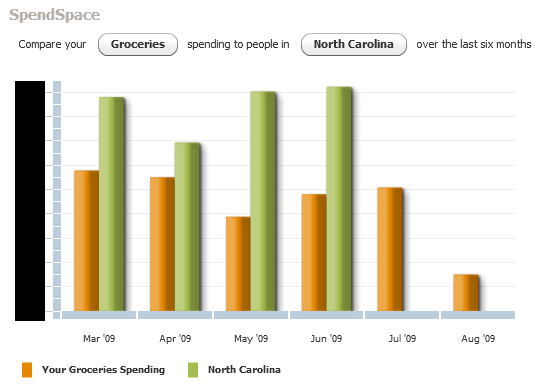

One other spending view that Mint offers is the "SpendSpace" view. I rarely use this, but it's occasionally fun to look at. Here is my grocery spending over the past six months as compared to other folks in North Carolina:

As you can see, I spend way less than the average family for groceries (which makes sense, seeing as I'm only feeding myself). The missing data for July is odd; either the data has yet to be loaded up, or no one in North Carolina bought groceries in July. I'm guessing it's the latter. ;-)

Minor Gripes

I only have a few gripes with Mint. Every so often, Mint will have trouble connecting to my bank accounts. This can occasionally become an annoyance, especially when the connection failures last for a few days. All of the problems eventually clear up, however, and the service catches up with all the transactions it missed in the mean time.

There are ways the tool could be improved. I wish the cash flow view allowed you to view longer periods of time, and I've seen people calling for a cash flow predictor, which is an interesting idea. The folks at Mint seem willing to listen to the public, which is great. Hopefully some of these improvements will show up at some point in the future.

Conclusion

Overall, I'm incredibly pleased with Mint. There are plenty of other features that I haven't listed here, many of which you may find useful (learn more at the Mint features page). Signing up for an account is free and easy, as long as you're willing to provide your financial login information.